With a centralized database, high-quality salary data, visual dashboards, and advanced analytics, payroll applications provide actionable insights for enterprises. They help predict future HR costs, determine increment amounts, and optimize variable payouts. Also, since the productivity of payroll employees would be low because of the manual nature of their work, the HR costs would add up significantly in the long run. It initiates an automated workflow assigned to the HR team to validate and approve the expense claims within preset timelines per company policy.

- Running payroll by hand requires a lot of time and resources that could be spent on other business matters that require your attention.

- Global payroll automation enables you to pay your domestic and international team members in minutes.

- Our cards integrate with payroll and accounting software including Square Payroll, Quickbooks, NetSuite, and Xero.

- While cost is an important consideration for any business service, Boettke said it’s essential to consider the overall value you’re receiving from your service provider.

- Payroll automation is often the starting point for broader HR automation initiatives.

- It reduces the margin for human error, and in turn the risk of expensive penalties and mistakes.

Benefits of Payroll Automation

One of the most significant benefits of an automated payroll system is the time and cost savings it provides. By eliminating manual calculations, these systems can drastically reduce the time spent on payroll processing. An automated payroll system is a software platform that automatically completes many tedious aspects of payroll processing in place of manual human labor. This includes all the standard calculations and steps from deductions to direct deposit, as well as less common ones, like collecting garnishments or tracking tips.

How do I automate payroll in excel?

With these benefits in mind, you can see why many small businesses are turning to automated payroll providers to simplify their payroll runs. You want to make sure they’re paid correctly and on time, https://www.bookstime.com/bookkeeping-services/kansas-city and payroll automation does just that. Automated payroll helps ensure that you meet payment deadlines and calculate the correct withholdings for your employees. Payroll automation software has the capability to adapt to new tax laws, helping you stay compliant while streamlining administrative processes.

Increased accuracy and compliance

- There are a few key benefits of automating your payroll processes, and the most important one is that it decreases your responsibilities as a business owner.

- Payroll applications auto-generate challans for statutory deductions such as EPF, pension amounts, professional tax, and TDS per preset deadlines.

- This is especially valuable since tax structures, payment methods, and other legal factors differ significantly for these work arrangements across the globe.

- In turn, this data automatically feeds into payroll and creates a more accurate — and less error-prone — process.

- If you’re already making major changes to your IT infrastructure, you might as well upgrade all your employee management tech.

- You may want to link your payroll platform with your human resources software.

- You can also make sure you have enough people booked for each shift.

And processing this information manually requires careful review for accuracy. To make this task even more challenging, tax laws and regulations are always changing. Payroll automation is when software automates the payroll process for small and large businesses. This includes setting up direct deposits and calculating tax withholdings. HR and payroll teams use payroll automation to streamline tasks like calculating compensation, generating reports, and ensuring team members receive their salaries.

- Similarly, such timekeeping features allow management to track, audit, and report on how many hours their workforces are putting in.

- Thus, we encourage organizations to embrace these advancements and prepare for a more efficient and innovative future in payroll management.

- It is designed for businesses of all sizes and is scalable to meet any of the complex requirements of the HR Department.

- It reduces the administrative burden and enhances your security against fraud and data loss, making the entire global payroll process more efficient.

- Payroll automation ideas benefits can set the right tone for future HR automation endeavors.

- You can ensure employees get compensated fairly by automatically relaying hours worked and pay rates.

Four Benefits of an Automated Payroll System

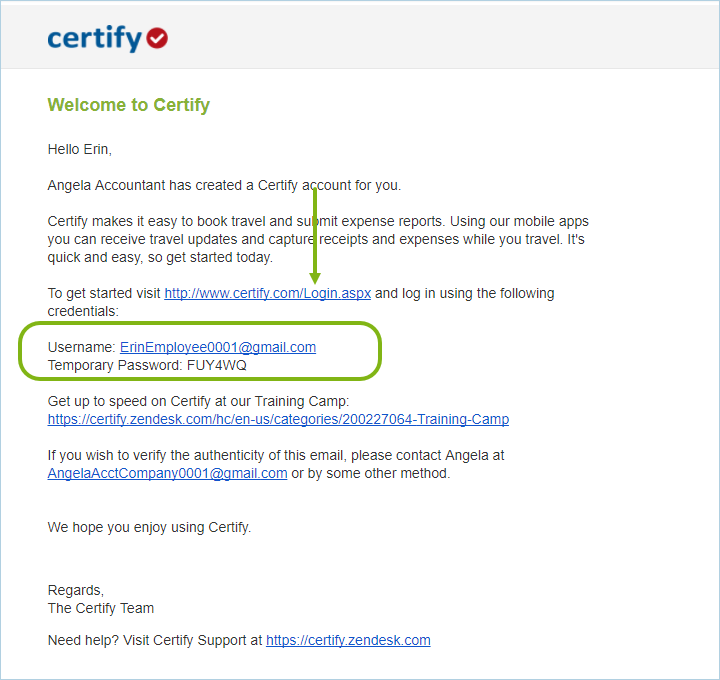

If your IT infrastructure is a mess, you may need to bring in an outside professional to help. Choose a payroll software that uses encryption to protect data transfers. Keep your system up-to-date so it has the latest patches and security measures. Application programming interfaces (APIs) are the most popular tool for integrating apps. Some software developers offer standard APIs to integrate their platform with common apps.

What is global payroll automation?

This speed is particularly beneficial during peak https://www.facebook.com/BooksTimeInc/ periods or when processing payroll for a large number of employees. Faster processing times also mean that employees receive their paychecks on time which builds trust and satisfaction. While you can file payroll taxes on your own, there’s always the risk of mistakes — and, with it, the potential for hefty non-compliance fines from the IRS. When you automate your payroll processes through a third-party vendor, you mitigate this risk and reduce your own administrative burden as a business owner.

- Several automated payroll systems are available, so you won’t have a shortage of legitimate choices.

- Automated payroll systems process data much faster than manual methods.

- To do so, you must not only take into account your employees’ earnings but also their benefits, withholdings, and taxes.

- Payroll doesn’t have to be complicated, but it does have to be right.

Global payroll automation simplifies your reporting by consolidating all of your employment data into one secure, cloud-based hub. This eliminates the need for manual processes and makes it easier to access accurate information quickly. By using software that automates many of these processes, you can save time, money, and resources and run a payroll operation that is more accurate and secure than a manual approach. The accounting team can complete these payments online through government portals and upload the receipts of these payments in the payroll system for compliance purposes. Year-end compliance, such as the generation of TDS certificates and tax forms (Form 16) you work for a company that provides payroll automation for employees, is also automated in payroll solutions.

Consider an all-in-one platform that includes multiple applications. For instance, When I Work offers payroll, time-tracking, and scheduling apps. All of our solutions have similar interfaces, which makes them easier to learn and use. Our solution includes payroll, scheduling, and time-tracking tools, all rolled into one. Integrating your payroll software allows core business apps to work together. Automated payroll solutions employ industry-standard security measures to safeguard your data.