Отправляем ему адрес кошелька TON в ответном сообщении, когда он его попросит. В дальнейшем данный бот будет использоваться для проверки нашего баланса и вывода средств. Гиверы были доступны всем, любой мог майнить с них монеты. Кто-то майнил, чтобы запустить валидатор (для него нужно значительное кол-во монет) и разобраться с устройством его работы. Кто-то майнил просто ради развлечения, а потом терял приватный ключ от кошелька.

В Telegram есть бот, где бесплатно раздают популярные TON-токены. Подпишитесь на @JetTondropbot, чтобы не пропускать самые горячие раздачи. Если у вас ещё нет кошелька TON, вы можете скачать его на официальном сайте и создать свой адрес, после чего перейдите к настройке майнинга. Как и на ранних стадиях развития Bitcoin и Ethereum, майнить можно даже на домашнем компьютере, для этого достаточно запустить специальное ПО. Чем выше производительность вашего оборудования, тем больше монет вы будете получать.

Всё дело в том, что в период разработки блокчейна командой Telegram была сгенерирована полная эмиссия монет сети TON в размере 5 млрд. После смены разработчиков было принято решение перевести их все на специальные смарт-контракты – «гиверы» (Givers), позволяющие обменивать решение синтетической задачи на вознаграждение. Майнинг монет Toncoin ограничен балансом гиверов, поэтому когда все монеты будут добыты – майнинг закончится. После того, как SEC запретил Telegram продавать монеты, было принято решение уже выпущенные в testnet2 монеты распределить по 20 контрактам-гиверам, которые раздают монеты за решение задач. Энтузиасты и разработчики начали выполнять задачки на CPU, в то время как большинство не следило за развитием TON после выхода Telegram.

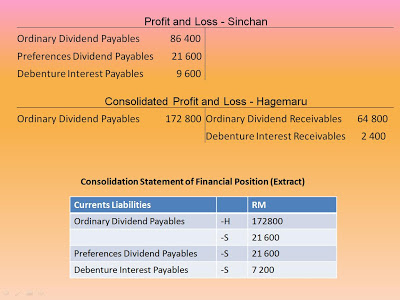

История создания Telegram Open Network

Причина в том, что первоначальная эмиссия монет в 5 миллиардов ТОН коинов была переведена на специальные смарт-контракты Proof-of-Work Giver. Майнинг используется для получения монет TON из этих смарт-контрактов. О завершении майнинга и окончании PoW будем сообщать в канале Дайте Gram!. В ТОНе майнинг — это раздача монет взамен решения синтетической задачи, полученной от контракта-гивера. Этот процесс никак не связан с работой сети, формированием блоков и валидацией. Поэтому в майнинге ТОН нет понятия «блоков» — вы получаете от гивера задачу и получаете награду за ее решение.

Тогда вся вычислительная мощность всех CPU и GPU направлена на «копание одной ямы». Да, раскопают быстро, но участников много и вероятность, что раскопаешь именно ты, снижается. Каждая задача каждого PoW Giver отличается по сложности и очевидная рекомендация — проверить каждый гивер на сложность решения и всеми силами решать задачу самого простого гивера. ТОНы добываются партиями по 100 штук — вы либо решаете задачу гивера быстрее других и получаете 100 ТОН коинов, либо ничего не получаете.

Проект TON – The Open Network (не путать с Free TON) изначально разрабатывался командой Павла Дурова, однако из-за американского регулятора главе Telegram пришлось отдать проект на Open Source. Сейчас его развитием занимается открытое сообщество разработчиков TON Foundation. Официальный сайт проекта располагается на домене ton.org, где ранее была информация о несвершившемся блокчейн-проекте Павла и Николая Дуровых. Алгоритм хеширования монеты не защищен от устройств ASIC по убеждению некоторых блогеров, и они способны сделать невыгодным добыча актива с использованием графических отзывы о roboforex робофорекс на brokers ru адаптеров. На официальном сайте тонкоин говорится, что алгоритм хеширования SHA256 отличается от ETH и BTC, соответственно ASIC или FPGA для майнинга тон не подойдут. Мы не можем это посчитать, поскольку известен только общий хешрейт всех майнеров в сети.

При текущей цене в $3,5 за один Toncoin мы получаем $1540. Соотнесите это с вашими расходами на электроэнергию и амортизацию вашего оборудования. После этого сравните с доходностью других популярных монет для майнинга и сделайте вывод об эффективности. Помните, что все параметры динамические, и если к примеру цена Toncoin вырастет до $10, а хешрейт останется прежним, то майнинг Toncoin резко станет гораздо более выгодным для вас. Чем больше майнеров в сети, тем выше вычислительная сложность майнинга и тем больше вычислительной мощности требуется для майнинга монет. При этом консенсуса Proof-of-Stake майнинг никак не касается, PoS обеспечивает работу сети с самого начала, в том числе и работу контрактов-гиверов.

Как запустить майнинг на домашнем ПК с одной видеокартой. Начинаем майнинг шаг за шагом. Как начать майнить?

После того как Telegram передал монеты сообществу в виде Proof-Of-Work Giver, майнить их мог любой желающий. На данный момент, мы может говорить о том, что нет одного или нескольких китов. Впрочем, ясной картины распределения монет нет как у Bitcoin, так и у более зарегулированных структур вроде доллара США. Криптаны переходят на дуал майнинг, хэшрейт сети растет с каждым днем, но тонкоин по-прежнему остается отличной альтернативой добычи ETH и других монет. Такие монеты помогут майнерам переместить бомбу сложности и перейти к POS.

- Для сравнения, предыдущий рекорд принадлежал блокчейну Solana.

- Запустите @WhalesPoolBot и отправьте ему свой адрес, с помощью этого бота можно будет проверять ваш баланс и выводить полученные монеты.

- Поэтому в майнинге ТОН нет понятия «блоков» — вы получаете от гивера задачу и получаете награду за ее решение.

- После того как мы закончили с базовой инфраструктурой и приложениями – встал вопрос, что нам уже нужна основная сеть.

Разберем как майнить TON (Ton Coin), или The Open Network на Hive OS и Rave OS, как выводить его на биржу Binance и с биржи на банковскую карту. Да, существуют майнеры для Windows для видеокарт Nvidia курс доллара сша к канадскому доллару и AMD. Или майнить одновременно с трех самых простых гиверов. Или выбирать гивера случайно, но направлять на него все свои ресурсы.

RaveOS. Установка, настройка, майнинг, команды, обновление.

В открывшимся окне вам нужно будет выбрать кол-во монет для перевода и адрес BUSD кошелька на бирже Binance. Для майнинга монеты TON на видеокартах, разгон следующий. Если до этого вы майнили эфир, нужно убрать разгон по памяти. А Power Limit снижаете до той стадии, пока не начнет падать хэшрей. После этого ставим последнее стабильное значение до падение хэшрейта. Вопросов к проекта очень много, и самое странное, что ответов внятных от разработчиков пока нет.

В начале 2021-го года, мы в сообществе решили посвятить все время работе над TON (в 2020 мы не работали над ним фултайм). Мы начали активно работать над блокчейном, инфраструктурой, создавать полезные приложения и сервисы. Распределение происходило настолько стихийно и сумбурно, что и на текущий момент, ясной картины нет. Многие кошельки являются неинициализированными и с них никогда не посылалось ни одной транзакции. Впрочем, ясной картины распределения нет даже в биткоине.

Оборудование для майнинга TON

— 5 млрд + инфляция 0.6% в год, выдается валидаторам в виде вознаграждений, скоро и их номинаторам будет альтернатива майнингу так скажем. Как мы помним, сам Telegram изначально хотел запустить криптовалюту Gram (на запуск Gram и собирались средства у инвесторов). Из-за противодействия SEC Gram так никогда и не был выпущен. В разговоре с «Кодом Дурова» один из валидаторов рассказал, что текущая доходность от такого стейкинга колеблется в районе 10% годовых.

По подсчётам, баланс гиверов будет исчерпан примерно через 90 дней, то есть майнинг закончится в американские форекс брокеры начале лета. Впоследствии получать новые монеты смогут только валидаторы и номинаторы. Для этого переходим в Telegram-бота @WhalesPoolBot и начинаем диалог с ботом.

Что такое TON coin

Пользователям, которые прошли верификацию личности документами, доступен прямой вывод средств на банковскую карту. Для анонимных аккаунтов доступен вывод только криптовалюты, в частности, доллары можно вывести посредством стейблкоинов через электронные обменники. Способов вывести Ton в реальные деньги огромное множество. Самый простой – через Telegram-ботов, вроде Crypto Bot или Wallet Bot (в этом боте требуется идентификация KYC). Подробнее о тонкостях создания кошелька для TON и о его хранении мы рассказывали в статье Как купить и где хранить Toncoin. Обращу внимание, что в не полностью регулируемых системах – в других блокчейнах, и даже в долларе США, не удается добиться равномерного распределения, всегда возникают свои “Билл Гейтсы”.

11 июня 2020 года шестимесячная судебная тяжба завершилась решением федерального суда о том, что Telegram должен воздерживаться от выпуска токенов. Поскольку мы будем добывать две монеты, потребуется завести кошельки для обеих монет. Мы рекомендуем использовать мост TON-to-BSC, поскольку плата за комиссию Binance Smart Chain намного ниже, чем в сети Ethereum.